Your medical health insurance card is greater than just a bit of plastic—it’s the key to having access to healthcare services and ensuring your claims are processed smoothly. but, for lots, it looks like a cryptic document full of numbers, acronyms, and strange terms. false impression this card can cause denied claims, surprising payments, and irritating smartphone calls.

This complete guide will walk you through each segment of your insurance card, explaining what every piece of data approach and why it’s essential for you. by using the end, you may be able to confidently gift your card at scientific appointments and recognize your insurance at a glance.

Why understanding Your coverage Card is Non-Negotiable

think of your coverage card as your healthcare passport. simply as you wouldn’t journey overseas without understanding your passport, you should not navigate the healthcare system with out decoding your insurance card. It incorporates all the important data that healthcare carriers need to verify your coverage, put up claims efficaciously, and determine your financial duty. A simple error in studying the card can result in a provider the use of previous facts or billing the incorrect insurer, leaving you to clean up the mess.

A Step-by means of-Step Breakdown of Your insurance Card

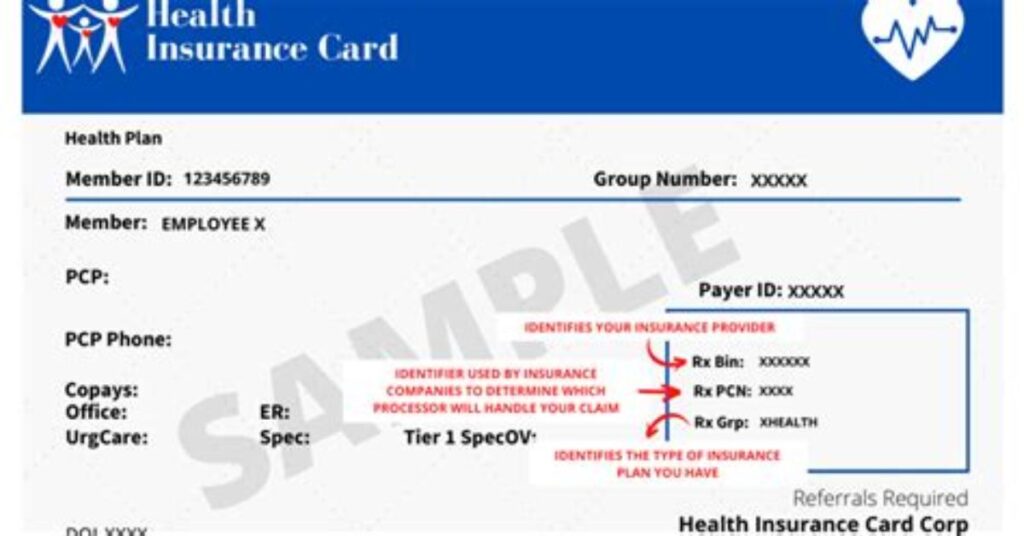

whilst designs range with the aid of insurer (e.g., UnitedHealthcare, Blue cross Blue guard, Aetna, Cigna), maximum playing cards comply with a comparable format. right here’s what to search for, phase by using phase.

1. Your private identity details

This phase uniquely identifies you because the policyholder or a protected based.

- Member call: this is the name of the character covered under the plan. critical note: in case you are the number one policyholder (e.g., thru your task), your card may have your call. For dependents (spouse, children), the cardboard ought to have their name, now not yours. continually check this fits the affected person’s government-issued identification.

- Member identification/policy quantity: this is your specific identifier for the insurance employer. It’s regularly an extended string of numbers and/or letters. you will use this whenever you schedule an appointment, fill a prescription, or correspond together with your insurer. It’s the most important wide variety on the cardboard.

- Date of start: commonly indexed to in addition verify identification.

- Gender: can be included for identity purposes.

2. The policy & institution statistics

This information identifies the plan itself, frequently tied to your enterprise or the entity via which you purchased coverage.

- group range: This identifies the specific plan offered with the aid of your organisation, union, or employer. each employee from the same agency enrolled inside the identical plan type can have the equal institution number. vendors and insurers use this to determine the precise advantages package you have.

- Plan type/Plan call: indicates the type of plan you’ve got (e.g., PPO, HMO, EPO, HDHP). that is crucial as it dictates your network rules and referral necessities.

3. The Insurer’s touch & Claims records

This tells you and your company who to touch.

- insurance business enterprise call & logo: The agency that gives your coverage (e.g., Kaiser Permanente, Humana).

- customer support cellphone variety: The number you name for questions on benefits, claims, or finding in-network vendors. store this to your cellphone.

- Claims Mailing cope with: where your healthcare company sends paper claims. you can need this for compensation if you pay out-of-pocket.

- Insurer internet site/Portal: most insurers have on line portals (or mobile apps) where you may take a look at claims, view advantages, download digital id playing cards, and locate medical doctors.

4. Plan-specific info That Dictate Your Care & prices

- That is the operational heart of your card, detailing how your plan works.

- primary Care doctor (PCP) call: critical for HMO plans. in case you see this, it approach you’re required to get a referral from this physician earlier than seeing a specialist. when you have a PPO, this subject can be clean or say “Your selection” or “None Required.”

- Copayment (Copay) amounts: these are the flat fees you pay on the time of carrier. Your card may also listing separate copays for:

primary Care go to

expert visit

urgent Care

- Emergency Room (word: ER copays are regularly higher, and you could still be billed for services past the copay.)

- prescribed drugs: frequently shown as levels like “familiar,” “emblem,” “forte” with corresponding prices (e.g., $10/$forty/$one hundred).

- Coinsurance: this is your percentage of the prices after you have met your deductible, shown as a percent (e.g., 20%). Your card might say “You Pay 20%” or “Coinsurance eighty/20,” that means the insurer can pay 80% and also you pay 20%.

- Deductible: the quantity you should pay out-of-pocket for covered services before your coverage begins to pay. a few cards listing the individual and own family deductible quantities right on the cardboard.

- Out-of-Pocket maximum (OOPM): the absolute maximum you’ll have to pay in a coverage yr for included services. after you hit this restrict, the insurance can pay a hundred%. this is your financial protection net.

5. network & Pharmacy facts

- community: the cardboard may additionally nation the community call (e.g., “PPO network,” “choice POS II,” “HMO superior”). You must use vendors on this community to get the best level of advantages.

- Pharmacy benefit manager (PBM): in case your prescription coverage is managed by a separate corporation (like explicit Scripts, CVS Caremark, or OptumRx), their emblem and make contact with information can be on the card. Use this info when filling prescriptions.

6. vital Codes & Dates

- Plan Code/RX Bin/PCN/Grp: these are alphanumeric codes used in the main for electronic transactions.

- RX BIN: The bank identity wide variety for processing pharmacy claims.

- PCN: The Processor control range, regularly used along the BIN for pharmacy claims.

- GRP: just like the institution variety, regularly used for pharmacy advantages.

- effective Date: The date your coverage started. offerings earlier than this date aren’t included.

- Expiration Date/valid through: The date your present day insurance ends. usually make sure your card is current.

FAQs: Your insurance Card Questions replied

Q1: My call is spelled incorrect on the cardboard. Is that a problem?

Q2: i’ve insurance cards. Which one do i take advantage of?

Q3: What must I do if I lose my coverage card?

Q4: The health practitioner’s office scanned my card, however I nonetheless got a massive invoice. Why?

End: Your Card, Your manage

Your medical health insurance card is a powerful tool. decoding it empowers you to grow to be an energetic, knowledgeable participant in your healthcare journey. It allows you avoid wonder payments, get admission to care efficiently, and recommend for yourself with self belief. Take ten mins nowadays to pull out your card, line it up with this manual, and make yourself familiar with every discipline. keep the customer service quantity to your contacts, download your insurer’s app, and keep your card accessible.