As we navigate 2026, house owners coverage stays an vital protect for one among lifestyles’s maximum substantial investments—your private home. With evolving climate styles, financial shifts, and advancements in home generation, knowledge the average price and components of house owners coverage is extra vital than ever. This comprehensive guide will discover projected premiums for 2026, elements influencing prices, regional versions, and actionable recommendations to secure optimal insurance with out overpaying. whether or not you’re a first-time purchaser or a long-term home owner, staying knowledgeable will assist you’re making financially sound decisions in a dynamic coverage panorama.

Expertise owners insurance in 2026

owners coverage gives financial protection against damages to your property and personal assets, legal responsibility for accidents on your private home, and extra living expenses if your own home turns into uninhabitable. In 2026, the average annual premium within the united states of america is projected to variety between $1,600 and $2,200, reflecting a constant growth from previous years due to inflation, heightened natural catastrophe risks, and growing creation costs.

numerous core coverages represent a well-known coverage:

- living insurance: Protects the physical structure of your property.

- private assets insurance: Covers assets within the home.

- liability safety: Shields you from legal duty for accidents or assets damage.

- extra dwelling prices (ALE): pays for transient housing if your own home is beneath repair.

Insurers in 2026 are increasingly incorporating era, which includes clever home sensors and AI-pushed hazard assessments, which may also have an effect on both pricing and coverage accessories.

Key factors Influencing owners coverage charges in 2026

1. area and regional risks

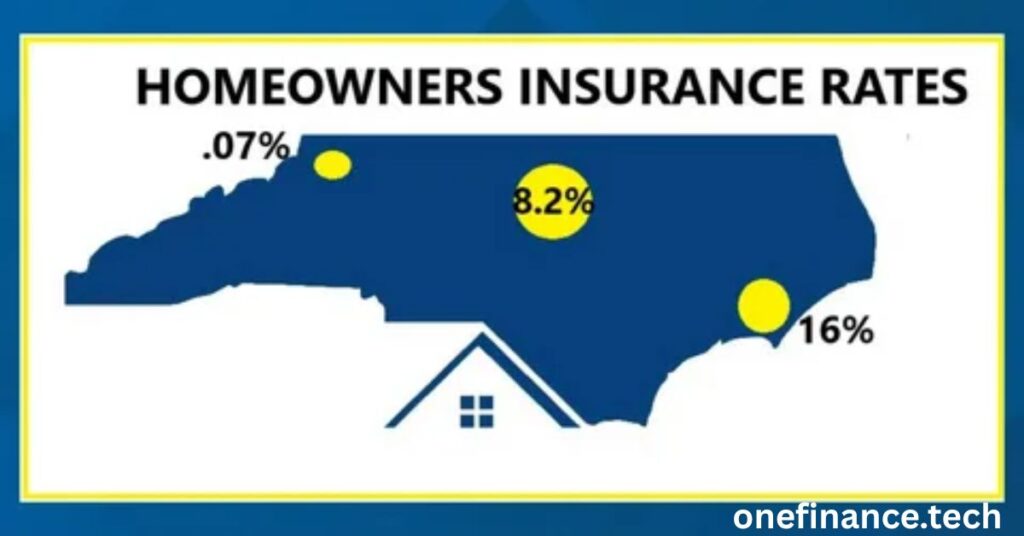

Geographic area drastically impacts premiums. homes in regions susceptible to hurricanes, wildfires, floods, or tornadoes typically face higher quotes. for instance, coastal states like Florida and Louisiana can also see rates 50–a hundred% above the country wide common because of hurricane publicity, even as wildfire-inclined areas in California and Colorado additionally experience expanded charges.

2. domestic characteristics

- Age and production: Older homes may cost a little extra to insure due to old electric or plumbing systems, even as more modern homes constructed with disaster-resistant materials would possibly qualify for reductions.

- rectangular footage and Rebuilding charges: large houses or people with high-quit finishes boom replacement prices, raising charges.

- Roof circumstance: A more recent, durable roof can lower coverage fees, specifically in hail- or wind-inclined regions.

3. non-public elements

- credit score: In most states, a better credit score can cause decrease charges, as insurers accomplice it with decrease threat.

- Claims records: common past claims might also growth your costs.

- Deductible preference: choosing a higher deductible reduces your top rate however increases out-of-pocket expenses at some stage in a declare.

4. coverage Limits and coverage f9ef7d9e905d1a4504697a5c6dd610d7

choosing higher coverage limits or adding endorsements for valuables, sewer backup, or identification robbery will enhance rates. In 2026, cyber protection endorsements are getting greater not unusual as virtual dangers develop.

state-with the aid of-state Breakdown of average charges in 2026

whilst national averages provide a baseline, premiums range broadly by kingdom. here are project accessories for select states in 2026:

- Florida: $three,800–$four,500 (highest due to hurricanes and litigation weather)

- Oklahoma: $three,two hundred–$3,800 (twister and extreme hurricane dangers)

- Texas: $2,800–$3,500 (hurricanes, hail, and windstorms)

- California: $2,500–$3,2 hundred (wildfires and earthquakes, although quake coverage is regularly separate)

- Midwest States (e.g., Ohio, Indiana): $1,2 hundred–$1,800 (lower hazard profiles)

- Northeast States (e.g., Vermont, Maine): $1,four hundred–$1,900 (slight risks, winter weather)

those estimates anticipate a fashionable coverage for a $three hundred,000 domestic with $three hundred,000 legal responsibility insurance and a $1,000 deductible. continually request customized quotes for accuracy.

The way to keep on owners coverage in 2026

no matter rising averages, proactive owners can leverage several techniques to lessen charges:

1. package deal rules

Combining house owners and car insurance with the equal issuer frequently yields discounts of 10–20%.

2. enhance home safety

putting in protection structures, smoke detectors, water leak sensors, and hurricane shutters can qualify you for reductions. In 2026, integrating clever domestic era that prevents harm (e.g., computerized water shutoff valves) is more and more rewarded.

3. keep around yearly

gain rates from as a minimum three insurers every year. evaluation buying remains one of the handiest ways to ensure competitive pricing.

4. increase Your Deductible

increasing your deductible from $500 to $1,000 or $2,500 can lower your top class by means of 10–25%, but make sure you have got financial savings to cover the better out-of-pocket fee if wished.

5. preserve a robust credit score Profile

Pay payments on time, lessen debt, and reveal your credit score record for errors to assist relaxed higher fees in states wherein credit score is a score element.

6. Ask approximately reductions

Inquire approximately discounts for loyalty, claim-free records, new domestic purchases, or club in expert add-ons.

7. assessment and modify insurance annually

make sure you’re not over-insured with the aid of updating your coverage to reflect cutting-edge domestic fee and belongings. get rid of coverage for gadgets you not very own.

destiny tendencies Impacting homeowners coverage costs

1. climate trade and Catastrophic activities

growing frequency and severity of natural failures will continue to power up charges, mainly in high-danger zones. a few insurers may also restriction coverage availability, pushing homeowners towards country-run truthful plans.

2. Technological Integration

smart domestic devices that mitigate dangers (e.g., fireplace suppression structures, leak detectors) will become more influential in pricing. Insurers may additionally provide lower costs for homes ready with those technology.

3. construction cost Inflation

growing fees for labor and substances suggest higher alternative expenses, which immediately have an effect on rates.

4. Cyber and Non-conventional dangers

As houses turn out to be more linked, demand for cyber safety endorsements will grow, potentially including to policy prices.

5. Legislative adjustments

state regulations concerning coverage charges, declare dealing with, and required coverages can shift pricing landscapes. live knowledgeable approximately neighborhood law changes.

often requested Questiadd-ons (FAQs)

what’s the average cost of house owners insurance in 2026?

Why has house owners coverage extended so much?

Does homeowners insurance cover flood damage?

How can i decrease my premium without sacrificing insurance?

package deal rules, increase deductibles, set up defensive devices, keep top credit, and keep around frequently.

Is homeowners insurance obligatory?

unlike car coverage, it’s now not legally required via country law, but loan creditors generally mandate it. Even in case you personal your private home outright, insurance is strongly recommended.

what is replacement value vs. actual cash value?

substitute fee covers rebuilding or repairing your house at modern charges, with out depreciation. real cash price elements in depreciation, paying much less for older gadgets. replacement fee insurance is extra complete but charges greater.

Are domestic-based add-ons/accessories covered underneath fashionable policies?

commonly, no. you may need a separate commercial enterprise coverage coverage or a domestic commercial enterprise endorsement to cowl commercial enterprise device and legal responsibility.

How regularly ought to I review my homeowners coverage coverage?

annually, or each time you make add-ons home improvements, collect valuable gadgets, or experience way of life changes.

End

Navigating owners insurance in 2026 calls for consciousness of both macroeconomic trends and personal situations. at the same time as average costs are mountain climbing, knowledgeable house owners can take proactive steps to relaxed strong coverage at reasonable costs. frequently think again your coverage, put money into home upgrades that reduce risk, and examine prices to conform to the evolving insurance marketplace. shielding your own home isn’t always only a monetary necessity—it’s peace of thoughts for you and your family. through staying knowledgeable and engaged, you can make certain your maximum precious asset remains safeguarded for future years.