shopping for auto coverage is extra than just a prison requirement—it is a vital financial protection internet. yet, for lots drivers, the process feels shrouded in jargon, complex pricing, and nice print. choosing a policy primarily based entirely on the lowest top rate may be a costly mistake, probably leaving you underinsured while you want assist the maximum.

the key to clever insurance buying is not just getting fees; it’s approximately asking the proper questions. An informed dialogue together with your agent or insurer transforms you from a passive customer into an empowered client. This guide walks you thru the eight most important questions you have to ask before signing on the dotted line. through knowledge the answers, you may tailor a coverage that provides sturdy protection to your car, your price range, and your peace of thoughts, all at a cost that makes sense in your specific state of affairs.

1. What varieties of coverage Are blanketed, and What Are the bounds?

that is the foundational query. insurance isn’t a one-length-suits-all product. You want to apprehend exactly what you’re purchasing.

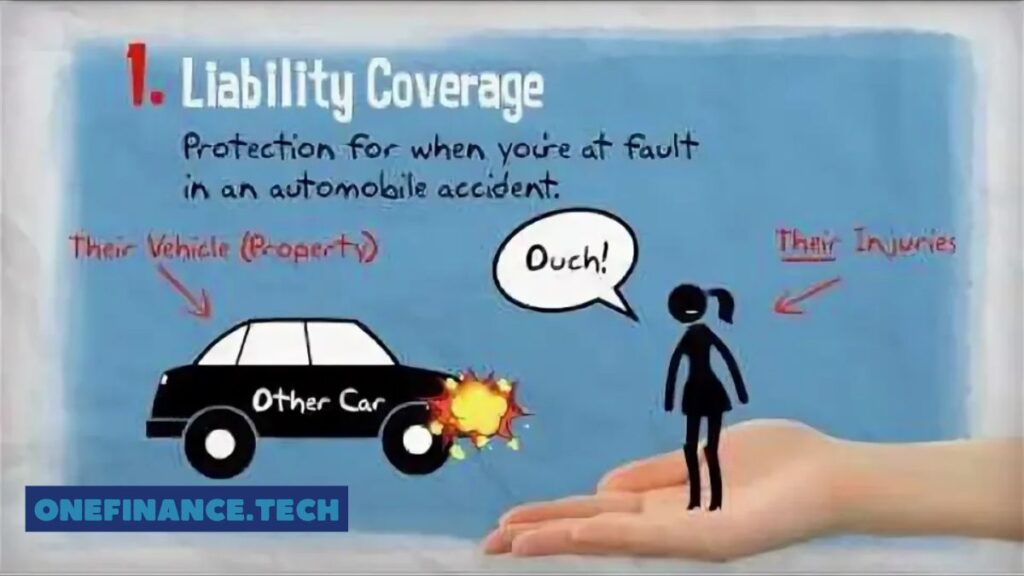

- liability coverage (bodily injury & property damage): that is legally required in maximum states. It pays for accidents and harm you reason to others in an twist of fate. the limits are normally expressed as 3 numbers (e.g., a hundred/300/50). this indicates $a hundred,000 per man or woman for physical damage, $three hundred,000 overall per twist of fate, and $50,000 for belongings damage. Ask: “Are these country minimums, or do you advocate higher limits?” nation minimums are often woefully inadequate. professionals often propose 250/500/one hundred or better to protect your belongings from a lawsuit.

- Collision & comprehensive: Collision covers damage to your vehicle from an twist of fate. complete covers non-collision occasions like theft, vandalism, fireplace, or hitting an animal. Ask: “what is the real cash value (ACV) vs. agreed fee?” ACV elements in depreciation, that’s widespread, however it is essential to recognise how your payout is calculated.

- Uninsured/Underinsured Motorist (UM/UIM): this saves you if you’re hit through a driving force with out a or inadequate coverage. Ask: “Is UM/UIM protected, and does it match my liability limits?” this is essential insurance frequently left out.

- pro Tip: don’t simply focus on fee; cognizance at the price of the insurance package. A barely higher top rate for extensively higher limits is usually a clever investment.

2. what is going to My Deductible Be, and the way Does It affect My top class?

The deductible is the quantity you pay out-of-pocket earlier than your coverage kicks in on a claim (for Collision and comprehensive). It’s a direct lever controlling your top class.

- better Deductible = lower top class: selecting a $1,000 deductible over a $250 deductible will significantly decrease your monthly or annual price.

- decrease Deductible = higher top class: you will pay extra often for the security of a smaller upfront fee if you record a claim.

- Ask: “What are my deductible alternatives, and what is the top class distinction for each?” comply with up with, “Do i have a separate glass/windshield deductible?” a few rules offer zero-deductible glass coverage.

- The bottom Line: select a deductible you may comfortably come up with the money for to pay in an emergency. If $1,000 could reason monetary pressure, opt for a decrease one, even supposing it costs a bit more month-to-month.

3. What reductions Do I Qualify For?

Insurers offer a myriad of reductions, but they won’t always practice them automatically. it’s your process to invite and make sure you’re receiving every credit you deserve.

- common discounts: safe driving force, multi-policy (bundling home and auto), multi-automobile, appropriate pupil, paid-in-full, automatic bills, low annual mileage, protective using path completion, automobile safety capabilities (anti-lock brakes, anti-robbery gadgets), and affiliation discounts (thru employers, alumni organizations, and so on.).

- usage-primarily based reductions: Many organizations now offer programs wherein a telematics device or mobile app monitors your riding conduct (mileage, braking, speed, time of day). safe drivers can earn massive reductions.

- Ask: “can you offer a complete listing of available reductions and overview my eligibility for every one?” Be proactive and point out any secure driving behavior, low mileage, or safety capabilities to your automobile.

4. How Do You deal with Claims, and what’s the method?

Your insurer’s actual test comes whilst you need them most—after an twist of fate. A cheap coverage is a terrible good buy if the claims service is sluggish, antagonistic, or frustrating.

- Claims procedure: Is there a 24/7 claims hotline? can you start a claim thru a mobile app? How are estimates dealt with—through in-residence adjusters or a network of repair stores?

- repair community: Ask: “Do you’ve got a direct restore software (DRP) or preferred stores? Am I required to apply them, or am i able to choose my very own mechanic?” the use of a favored save regularly comes with a lifetime guarantee on upkeep, that’s a precious advantage.

- rental repayment: Ask: “If my car is in the shop, does my coverage include apartment reimbursement, and what are the daily and general limits?” this is regularly an upload-on but is tremendously useful.

studies the agency’s claims satisfaction scores from unbiased resources like J.D. electricity or the national affiliation of coverage Commissioners (NAIC) grievance index.

5. What factors could Make My top rate increase (or lower) in the future?

know-how what drives your rate enables you’re making lengthy-time period selections. rates are not static; they trade at renewal based on new records.

- not unusual elements for will increase: At-fault accidents, transferring violations (rushing tickets, DUIs), comprehensive claims (even for occasions like hail), a alternate in credit score rating (in most states), transferring to a higher-threat area, or including a younger motive force.

- factors for Decreases: preserving a smooth riding report, enhancing your credit rating, getting married, achieving positive age milestones (like 25), or transferring to a safer area.

- Ask: “aside from accidents and tickets, what different factors most have an effect on top class modifications at renewal together with your employer?” This reveals in the event that they heavily weight credit score, mileage, or other variables.

6. How Does My using Profile and car desire have an effect on My price?

Be honest about your situation. Your each day go back and forth duration, annual mileage, or even your occupation can have an effect on your price.

- using Profile: Ask at once: “How do you rate drivers primarily based on annual mileage, go back and forth distance, and primary use (delight, business, commute)?”

- car choice: the car you force is a prime score thing. sports activities vehicles and luxury vehicles value extra to insure than minivans and sedans. Ask: “earlier than I purchase a brand new vehicle, can i am getting a quote for one of a kind fashions to look the insurance price difference?” protection scores, restore fees, and robbery charges all play a function.

7. what is Excluded from My policy? (examine the excellent Print)

guidelines have exclusions—particular situations they’ll now not cover. understanding these is as important as knowing what is protected.

- commonplace Exclusions: using your non-public vehicle for business delivery (e.g., Uber Eats, DoorDash), racing, intentional harm, put on and tear, or mechanical breakdown. a few policies may additionally exclude aftermarket components or have particular policies approximately used components in upkeep.

- Ridesharing hole: in case you on occasion drive for a rideshare corporation, non-public automobile insurance commonly might not cowl you at the same time as the app is on. You want a particular endorsement or industrial coverage.

- Ask: “can you factor me to the important thing exclusions within the coverage documents?” Request a pattern policy to review.

8. what’s the perfect way to manage My policy and Make adjustments?

convenience matters within the virtual age. A consumer-friendly insurer can prevent time and hassle.

- digital tools: Ask: “Do you have a totally purposeful cellular app or consumer portal wherein i’m able to view my identity playing cards, make bills, report claims, request policy adjustments, and see my claims history?”

- Human support: “If I want to speak to a person, what are your customer service hours, and what’s the everyday wait time?” The first-class groups combo high-quality digital gear with reachable, informed human assist.

This question ensures your coverage experience is easy no longer simply at buy, however for the lifetime of your policy.

FAQs for “eight questions to Ask earlier than shopping for car insurance”

Q1: what’s the maximum important question to ask while shopping for automobile insurance?

Q2: Is selecting the cheapest vehicle insurance always a bad concept?

Q3: How does my deductible desire in reality affect me?

Q4: What need to I ask approximately the claims procedure?

End: From questions to confidence

buying car insurance have to be a deliberate, knowledgeable system, now not a rushed decision. by means of asking these 8 important questions, you circulate beyond comparing mere rate tags and start evaluating real fee, service exceptional, and long-time period suitability. you may gain a clean understanding of your safety, your costs, and your insurer’s commitment to you.